MANSFIELD — Jaden Zering, a graduate of the University of Connecticut, lived off-campus during his final two years at the university.

Zering, who hoped to live independently, described the rental market in Mansfield as “frustrating, to say the least,” because of the high rent prices. As a result, he decided to live with friends to reduce costs.

This affordability issue is a problem that has affected not only Zering and Mansfield but the entire state.

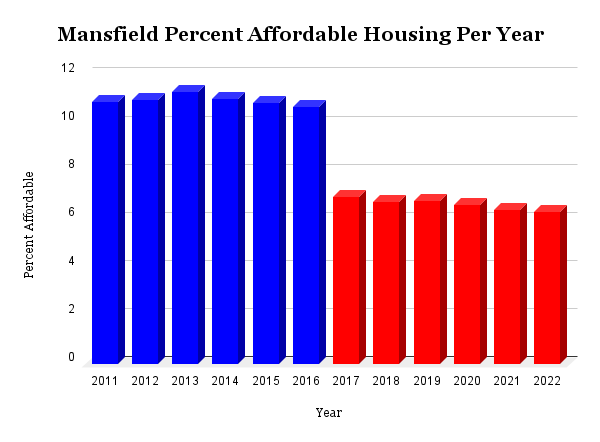

From 2016 to 2017, the percentage of affordable housing in Mansfield sharply fell from 10.7% down to 6.9%, according to CT Data. A falloff that Mansfield Mayor Antonia Moran credits to the construction of The Oaks on The Square, an apartment complex in the middle of the UConn campus.

With the sudden influx of units in the town caused by this construction project, “the percentage of rental housing that is deed-restricted plummeted,” said Moran.

Deed-restricted housing, which is another term for affordable housing, is housing that is restricted to ensure that the units remain affordable to individuals or families with lower incomes.

Because of this sustained dip below 10% affordable, the town of Mansfield currently falls under Connecticut State Statute 8–30g. This statute allows developers to bypass local zoning regulations if they provide 30% affordable units for 40 years.

“We have one developer that is planning to build 8–30g housing off of Hunting Lodge Rd., but most the developers are going through planning and zoning,” according to Moran.

Furthermore, from 2016 to 2017, the total number of assisted units in Mansfield dropped from 641 to 416. A number that has continued to slowly decline over the past six years, down to 379 units in 2022, according to CT Data.

As a result of the town’s hardships in making housing more affordable, the town council established the Affordable Housing Committee on October 25th, 2021.

The committee identified a 28% increase in median rent cost from 2010 to 2019. During this same period, the percentage of rental units that make up the town’s housing stock increased from 36% to 47%. The committee credits that rise to the construction of new rental units and the conversion of formerly owner-occupied homes into rentals, according to the Town of Mansfield Affordable Housing Plan.

As mentioned, this problem is not specific to Mansfield. Statewide, the median price of rent increased from $982 to $1,180 from 2010–2019. During that same timeframe, Mansfield saw a $302 increase itself, according to CT Data.

Another example of the statewide struggle with affordable housing can be seen in how many towns fall under the 8–30g statute. In 2022, out of the 169 towns in Connecticut, only 29 had above 10% affordable housing, while 94 towns had under 5% affordable housing, according to CT Data.

According to Forbes, Connecticut has the 9th highest cost of living across all 50 states in 2023.

Ultimately, Mansfield is a microcosm of the affordable housing issue that exists across the state.

However, Moran said the town has plans to put Mansfield above the 10% threshold again, saying that the town now requires each developer who goes through the planning and zoning regulations to have 15% of their units as deed-restricted affordable housing.

“The fact of the matter is that there is other affordable housing in town.” However, Moran also admitted, “There is very little quality housing. Those apartments tend to be old, they can be in pretty bad shape, and they are certainly pretty small.”

Moran also said she has toyed with the idea of using housing trust fund money to help these current apartment complexes and allow them to upgrade their buildings on the condition that they make the unit deed-restricted affordable.

While the unflattering affordable housing statistics in Mansfield could easily be attributed to the student population, Moran still admits, “We do have some people who don’t have enough money to buy a house in this market or just want to rent, and those folks are having a hard time finding affordable housing.”